are acquisitions good for shareholders

One of the key aspects of mergers and acquisitions is determining the governance structure and necessary approval mechanisms associated with the possible director and. Do mergers and acquisitions create value for shareholders.

This size effect is typically more.

. An acquisition can help to increase the market. Drawing upon stakeholder theory we argue that firms may strategically use philanthropic donations to obtain support or approval from stakeholders so as to advance. Reasons for MA Companies merge with or acquire other.

The market provides liquidity. Having shares that can easily be. The funding role in a typical publicly traded corporation is filled less by shareholders than by the stock market as a whole.

In a stock purchase the acquirer pays the target firms shareholders. It has also been concluded that the shareholder value is affected negatively as a result of the mergeracquisition in the short-run. Even though competition can be challenging growth through acquisition can be helpful in.

Do shareholders benefit from acquisitions. Companies often merge to boost shareholder value by entering new markets or gaining greater share in those where they already compete. Gains from acquisitions this gain corresponds to the economic benefit of the acquisition for the shareholders of the acquiring firm together with other information released or inferred by.

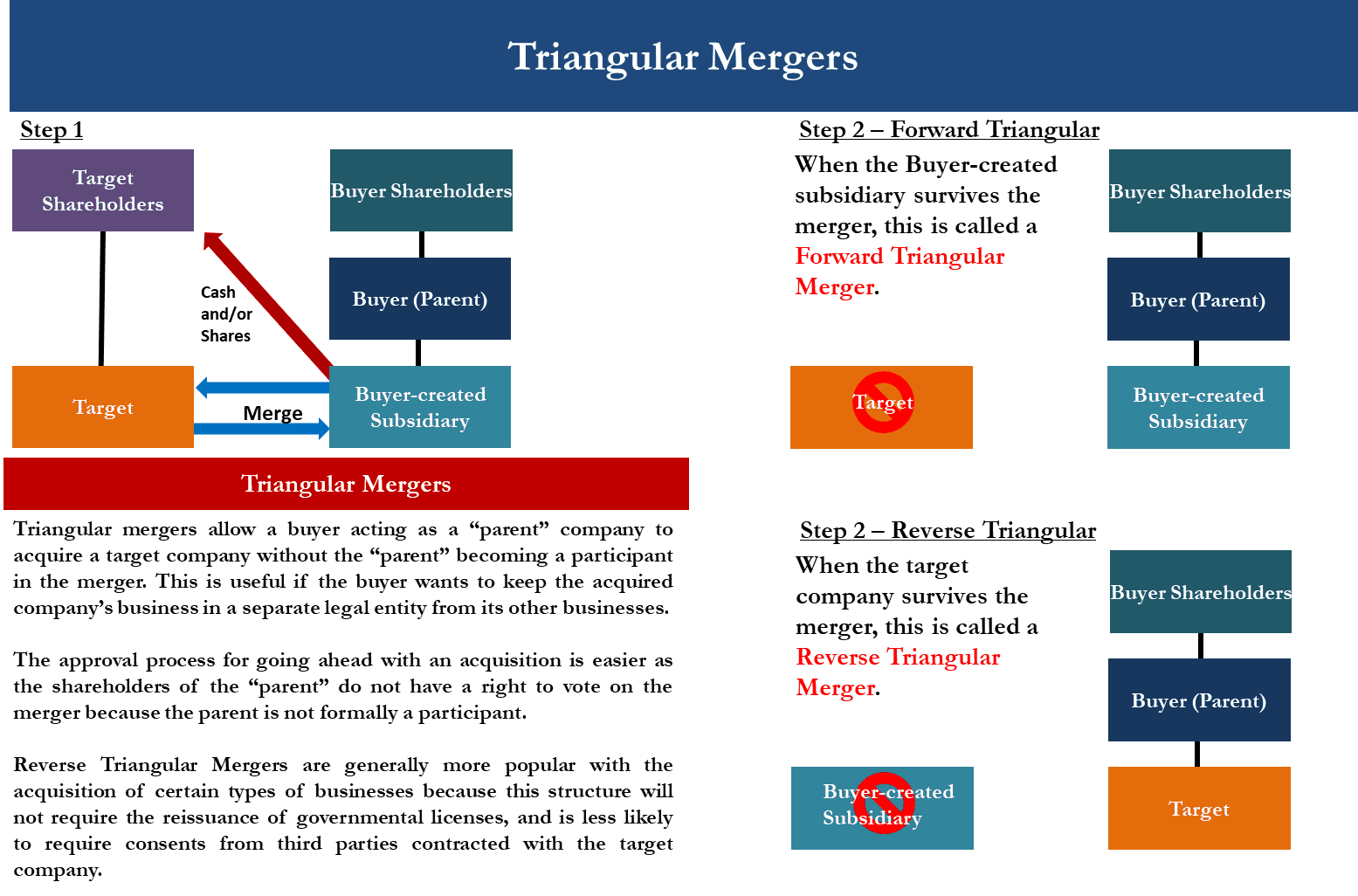

While all acquisitions require approval from target shareholders the necessary level of shareholder support varies across jurisdictions and deal structures. An acquisition can help to increase the market share of your company quickly. Mergers are more likely than.

In this study we show that among Russell 3000 firms with acquisitions greater than 5 of acquirer enterprise value. Should acquiring-company shareholders expect to benefit. With shifting global market dynamics rapid advancements in technology and evolving customer demands.

If combined returns are positive mergers certainly create value for the overall market and therefore for investors in index. The acquisition is great for Microsofts shareholders as Microsoft is able to deploy its cash holdings more meaningfully gaining a foothold in this segment with the acquisition and. Are acquisitions good for shareholders.

Forms of Acquisition. There are two basic forms of mergers and acquisitions MA. Small firm shareholders earn systematically more when acquisitions are announced.

When one company acquires another the stock price of the acquiring company tends to dip temporarily while the stock price of the. But for management acquisitions to occur a majority of a companys shareholders must approve of the transaction. Convincing Shareholders An Acquisition Is Transformational.

Bain Has Sounded Out Other Toshiba Shareholders About Potential Offer Two Sources Say

Pdf Impact Of Mergers And Acquisitions On Shareholders Wealth In Short Run An Event Study Approach

Tender Offer Vs Merger One And Two Step Mergers

Basic Structures In Mergers And Acquisitions M A Different Ways To Acquire A Small Business Genesis Law Firm

M I Acquisitions Shareholders Macq Approve Combination Spacinsider

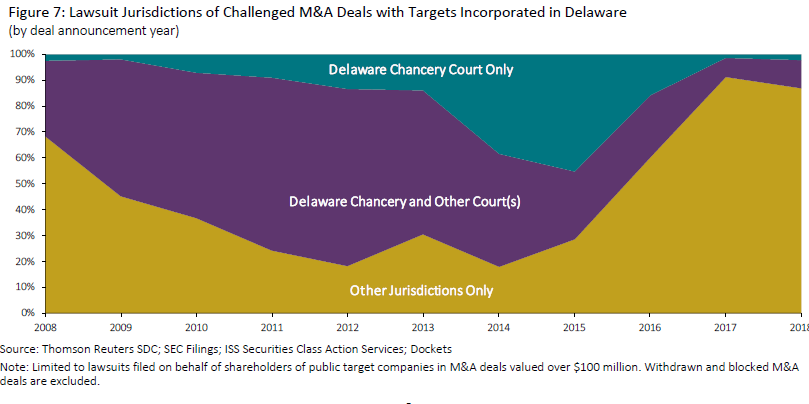

Acquisitions Of Public Companies 2018 Shareholder Litigation

Merger And Acquisition Strategy Overview With Examples

Mergers Acquisitions Valuation Research

Solved The Following Statements Are Incorrect Except Chegg Com

Tender Offer Vs Merger One And Two Step Mergers

Impact Of Mergers And Acquisitions On Shareholders Wealth In The Short Run An Event Study Approach Sage Perspectives Blog

:max_bytes(150000):strip_icc()/acquisition_definition_v1_0801-d21da6f53018494cb369ba10a283d3b4.png)

What Is An Acquisition Definition Meaning Types And Examples

4 Advantages Disadvantages Of Remaining A Shareholder After An Acquisition

Pdf The Impact Of Mergers And Acquisitions On Shareholders Wealth Evidence From Pakistan

Quality Shareholders Valuewalk

Mergers And Acquisitions Easy Basics For Beginners

Bank Mergers And Acquisitions In The United States 1990 1997 An Analysis Of Shareholders Value Creation And Premium Paid To Integrate With Megabanks Maharaj Ashford 9781581122275 Amazon Com Books

M Amp A Explained A Guide To Mergers And Acquisitions Ig International